Enjoy the experience of our restaurant.

Register to know our latest news.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt.

The Economic Update newsletter is comprised entirely of the expertise, thoughts, perspectives and opinions of the author with no use of generative AI. Data is sourced from the original providers (typically government agencies) and analyzed by the author.

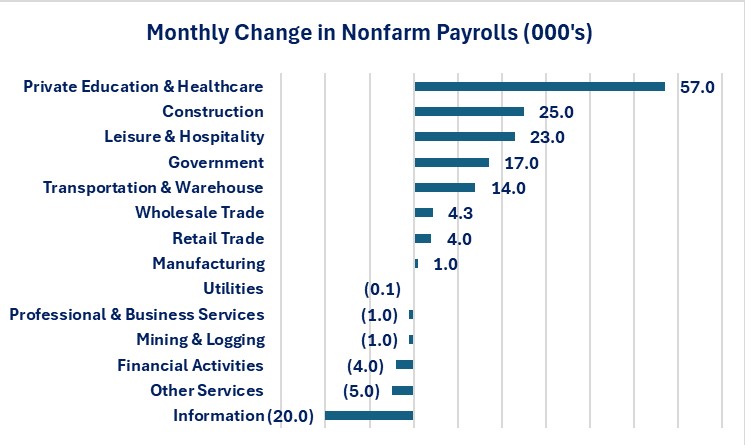

The Bureau of Labor Statistics (BLS) released data for the nation's employment situation as of 7/31/24 and the data was weaker than expected. The nation added 114,000 jobs in July compared to a median forecast from economists surveyed by Bloomberg of 176,000. The BLS also revised lower the data for the previous two months. The net result was a downward revision of 29,000 jobs.

Jobs Growth

Wage Growth

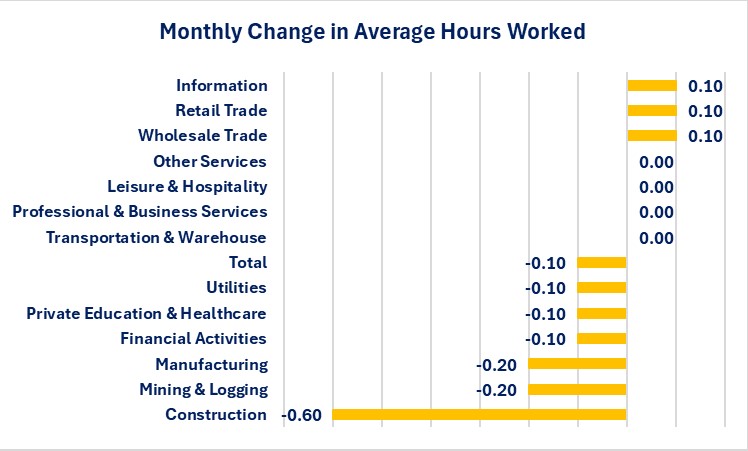

Hours Worked

The Household Survey showed smaller employment growth compared to the jobs growth reported from the Establishment Survey. According to the Household Survey, 67,000 new people found employment in June. The labor force participation rate rose from 62.6% in June to 62.7% in July.

The labor force grew by 206,000 but, the number of people unemployed grew by 352,000. This resulted in the unemployment rate rising from 4.1% in June to 4.3% in July.

In a sign of potential financial stress for workers who saw their hours reduced, the number of people working multiple jobs rose by 133,000. The number of people working multiple jobs continues to be higher than the peak before the pandemic crisis. The peak before the pandemic crisis was 8,390,000 while the number as of 7/31/24 is 8,473,000.

For those who were already unemployed, the data improved slightly. The average duration of unemployment fell from 20.7 weeks in June to 20.6 weeks in July. The percent of people who have been unemployed 27 weeks or more fell from 22.2% in June to 21.6% in July.

Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Enjoy our meals. You can click each menu to display more information.

Interest rates took a wild ride as vaccine euphoria versus winter is coming might be the best title to describe this week for fixed income investors.

The week started off with positive news but in the world of bonds, good news is generally bad for bond prices as yields rise. For the first three hours on Monday morning, financial markets moved in a single straight line frenzy with long-term yields reaching their highest levels since March. The catalyst for this move was an announcement from Pfizer/BioNTech that they have produced a vaccine that is showing promising results in preliminary testing, preventing greater than 90% of COVID-19 infections. This was great news and markets got wrapped up in the possibility of getting our society and economy back to normal. But euphoria is giving way to reality as these benefits may be more of a 2021 story. As the week ends, focus has pivoted from optimism over COVID-19 vaccine efficacy to increased infection rates. The national infection rate has trended toward 1.5%, the largest daily increase since late July, New York City has threatened to shut down in-person learning at public schools, and Chicago issued a stay-at-home advisory effective Monday.

Acknowledging the rising cases and the diminished chances for a fiscal package this year, Federal Reserve officials have turned dovish. Just last week, Fed Chair Jerome Powell said “We think that this very large effective (asset purchase) program is delivering about the right amount of accommodation and support for the markets,” but this week he indicated that the Fed may need to do more to combat near-term downside risks to the economy. Powell said this week, “We do see the economy continuing on a solid path of recovery, but the main risk we see to that is clearly the further spread of the disease here in the United States. A COVID-19 vaccine is certainly good and welcome news for the medium term. The next few months could be challenging. It's just too soon to assess with any confidence the implications of the news for the path of the economy, especially in the near term. The path forward is going to be challenging for a number of reasons, my sense is that we will need to do more, and that Congress may need to do more as well on fiscal policy."

The Fed has few options for further accommodation as rates are floored at the lower band and forward guidance indicates rates will remain at current levels through 2023. This leaves the possibility that they may revise Operation Twist which means buying more long-term securities.

Time will tell if this policy option becomes more of a possibility and market participants will be focused on the December Federal Open Market Committee (FOMC) meeting for guidance.

For the week, Treasury yields traded in a much wider range but still increased between 3 and 8 basis points.

Company Spotlight

|

APPLE INC |

Apple is in impressive financial health. We remain comfortable purchasing debt issued by the firm. |

|

AMERICAN EXPRESS CO |

American Express is in good financial health, evidenced by strong capital levels and exceptional credit quality. We remain comfortable purchasing debt issued by AXP. |

|

BOEING CO/THE |

Boeing's decision to shutter MAX production and the opacity surrounding a return-to-service timeline have put pressure on the firm’s credit metrics. We remain comfortable with our holdings of Boeing at this time. |

|

COLGATE-PALMOLIVE CO |

Colgate filed its 10-Q this week. We don’t anticipate the firm will have any problems meeting it’s near term debt obligations and remain comfortable purchasing debt issued by the firm. |

|

COSTCO WHOLESALE CORP |

Costco submitted its financial statements this week. They reflect a very strong company with little risk of default. We continue to remain comfortable purchasing debt issued by Costco. |

|

EBAY INC |

EBay’s financial statements reflect a company in healthy financial shape. We remain comfortable purchasing debt issued by the firm. |

|

GENERAL ELECTRIC CO |

GE's financial statements show a company that is navigating a transitionary period. We continue our wait-and-see approach to GE's massive corporate transformation. |

|

CORNING INC |

Corning released its 10-Q this week. The firm continues to maintain a strong balance sheet and consistent, healthy free cash flow. We remain comfortable with Corning's ability to meet debt obligations. |

|

ALPHABET INC-CL C |

Alphabet's financial statements, filed this week, show an impressively solid balance sheet and substantial free cash flow generation. We remain comfortable purchasing debt issued by the firm. |

|

HONEYWELL INTERNATIONAL INC |

Honeywell is an industry leader in both products and financial strength, we are comfortable purchasing debt issued by the firm. |

|

INTL BUSINESS MACHINES CORP |

IBM filed financial statements this week. The firm continues to generate adequate cash from operations to cover debt obligations. We remain comfortable purchasing debt issued by IBM. |

|

INTEL CORP |

Intel's financial statements show a company with manageable debt levels and meaningful cash flows. We believe Intel has no foreseeable problem meeting its future debt obligations. |

|

3M CO |

3M filed its 10-Q this week. The firm continues to report a strong balance sheet, ample liquidity and substantial free cash flow. We remain comfortable purchasing debt issued by the firm. |

|

MICROSOFT CORP |

Microsoft's financial statements continue to show consistently significant revenue generation and a strong balance sheet. We remain comfortable purchasing debt issued by the firm. |

|

NIKE INC -CL B |

With strong financial statements and the ability to allocate capital as management sees fit, Nike is in impressive financial health. We remain comfortable purchasing debt issued by Nike. |

|

ORACLE CORP |

Oracle submitted financial statements this week. The firm continues generate remarkably consistent free cash flow, sufficient enough to fund its generous capital return program and service its debt obligations. We remain comfortable purchasing debt issued by Oracle. |

|

PROCTER & GAMBLE CO/THE |

P&G reported a very nice quarter and the financial statements continue to reflect the benefits of scale. We remain comfortable with the firm's ability to service its debt obligations. |

|

TJX COMPANIES INC |

TJX's financial statements, filed this week, reflect a company in sound financial health. We remain comfortable purchasing debt issued by TJX. |

|

November 13, 2020

|

||||||

|

Index

|

Current

|

Last Week

|

Wk Chg

|

Last Year

|

Yr Chg

|

|

|

Tax-exempt MMF

|

.05%

|

.05%

|

.00%

|

1.01%

|

-.96%

|

|

|

Taxable MMF

|

.07%

|

.07%

|

.00%

|

1.74%

|

-1.67%

|

|

|

2-Year Treasury

|

.18%

|

.15%

|

.03%

|

1.59%

|

-1.41%

|

|

|

5-Year Treasury

|

.41%

|

.36%

|

.04%

|

1.63%

|

-1.22%

|

|

|

10-Year Treasury

|

.90%

|

.82%

|

.08%

|

1.82%

|

-.92%

|

|

|

30-Year Treasury

|

1.65%

|

1.60%

|

.05%

|

2.30%

|

-.65%

|

|

|

5-Year Exp. Inflation

|

1.65%

|

1.55%

|

.09%

|

1.54%

|

.11%

|

|

|

2-Year Corporate*

|

.41%

|

.38%

|

.03%

|

1.90%

|

-1.49%

|

|

|

5-Year Corporate*

|

.89%

|

.85%

|

.04%

|

2.17%

|

-1.28%

|

|

|

10-Year Corporate*

|

1.71%

|

1.67%

|

.04%

|

2.70%

|

-.98%

|

|

|

30-Year Corporate*

|

2.73%

|

2.74%

|

.00%

|

3.38%

|

-.65%

|

|

|

2-Year Municipal**

|

.31%

|

.28%

|

.04%

|

1.17%

|

-.86%

|

|

|

5-Year Municipal**

|

.43%

|

.41%

|

.02%

|

1.31%

|

-.88%

|

|

|

10-Year Municipal**

|

.99%

|

.97%

|

.02%

|

1.76%

|

-.77%

|

|

|

30-Year Municipal**

|

1.78%

|

1.74%

|

.04%

|

2.41%

|

-.63%

|

|

|

10-Year German Govt Bond

|

-.55%

|

-.62%

|

.07%

|

-.36%

|

-.19%

|

|

|

10-Year U.K. Govt Bond

|

.34%

|

.27%

|

.06%

|

.71%

|

-.37%

|

|

|

10-Year Japanese Govt Bond

|

.02%

|

.01%

|

.01%

|

-.09%

|

.10%

|

|

|

10-Year Spanish Govt Bond

|

.11%

|

.09%

|

.01%

|

.45%

|

-.34%

|

|

|

10-Year Italian Govt Bond

|

.66%

|

.64%

|

.02%

|

1.32%

|

-.66%

|

|

|

Fed Funds

|

.25%

|

.25%

|

.00%

|

1.75%

|

-1.50%

|

|

|

Prime Rate

|

3.25%

|

3.25%

|

.00%

|

4.75%

|

-1.50%

|

|

|

Dollar***

|

$92.75

|

$92.23

|

$0.52

|

$98.16

|

-$5.41

|

|

|

CRB

|

$151.86

|

$147.70

|

$4.16

|

$180.09

|

-$28.23

|

|

|

Gold

|

$1,886.10

|

$1,951.70

|

-$65.60

|

$1,473.40

|

$412.70

|

|

|

Crude Oil

|

$40.15

|

$37.14

|

$3.01

|

$56.77

|

-$16.62

|

|

|

Unleaded Gasoline****

|

$1.13

|

$1.08

|

$0.04

|

$1.49

|

-$0.37

|

|

|

Note: Municipal yields are as of the previous business day.

|

||||||

|

* Composite A

|

||||||

|

** General Obligation AA+

|

||||||

|

*** Int'l value of the U.S. dollar (Avg. exchange rate between the dollar and 6 major world

|

||||||

|

currencies).

|

||||||

|

**** Futures price per gallon

|

||||||